Unleashing Data’s Potential in Banking

August 19, 2022 2022-08-19 13:41Unleashing Data’s Potential in Banking

Unleashing Data’s Potential in Banking

With the drastic developments in the banking industry, it’s only fair for the banking sector to look for greater resources to provide them a competitive advantage. Using high-quality geospatial software, and taking advantage of the many capabilities and benefits it can provide is one way to accomplish this goal.

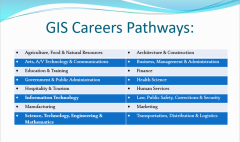

In today’s connected world, banks must be both market-driven and market-responsive. They must be able to anticipate consumer needs and wants and provide such services. GIS enables banks and other financial institutions to take snapshots of their personnel’ whereabouts, facility configurations, and asset locations. In this article, we focus on how GIS data is helping the banking industry.

Benefits of unleashing GIS data in banking

Here are examples of how GIS data is helping transform the banking industry.

- Customer Analysis and Management

Customer analysis can be used to identify customer traits, such as describing market segmentation of geographic areas. GIS can assist in converting a postal address into a location reference, such as the point on a map where it corresponds. It is possible to draw the branches’ catchment area and readily identify the places that are not covered. With GIS data, you can show a customer’s location in relation to a bank branch on a map.

- Execute strategic analysis

Financial organizations already face a challenging process of strategic planning. Banks may obtain the data they need to make informed strategic planning decisions with the help of geospatial data. Through “what-if” analysis, geospatial information aids in the strategic planning process. With the help of computer technology, banks can investigate how various geographic elements, such as infrastructure and economic development, may impact the viability of an enterprise and offers a projected estimate of the outcomes.

- Branch closure assessment

With the aid of GIS, a bank can evaluate the attractiveness of the markets in which its branches operate and determine whether to cut its presence there. However, GIS-based analysis of closure opportunities is particularly useful for forecasting the customer loss that would occur from closing a particular branch. GIS also provides the possibility to capture customer retention through transferring businesses to surrounding branches when one branch closes.

- Make better location set-up decisions

A bank’s expansion demands careful preparation. The location of the new branch or ATM must have sufficient demand and profit potential. A thorough understanding of your network distribution is necessary to pinpoint these areas because building there involves a large investment. Having evidence to justify an expansion can help management understand the need and geospatial data can help with that.

- Determine and monitor rivals’ activity

Geospatial software benefits banks by keeping track of the precise locations of both clients and competitors. Such information enables banks to visualize the market penetration of their rivals and spot performance trends. Does a rival perform especially well in a specific ZIP code, age group, or income level? The responses to these queries are extremely helpful since they shed light on the causes of a competitor’s current success.

- Carry out market penetration analyses

With geospatial software, market penetration research may be more effective. Using location-based data, banks can get market penetration information for the whole financial services sector and contextualize that information geographically. Market penetration analyses can help banks in identifying underdeveloped markets when compared against competition data. With the information gathered, a bank can decide to start a marketing campaign in areas where they would otherwise have disregarded.

- Enhance customer service

For financial institutions, providing excellent customer service is a major concern in the modern banking industry. Customers now want their demands to be satisfied and their questions to be resolved promptly in the new digital age. The demand has allowed banks to modernize their equipment, but GIS technology can help them provide even better customer service. By planning and positioning their branches in the optimal locations to reach the largest number of customers, banks can connect with their customers more effectively thanks to location-based data and technology. To better serve the local population and increase convenience, the department can provide the necessary services by using GIS technologies to evaluate the demographics surrounding each branch and identify the requirements of the community.

The financial sector benefits from geospatial data, which gives banks a variety of advantages not achievable with other data sources. Financial firms can track their competition and assess client engagement using this type of customer data. At Esri Eastern Africa, we provide customers with working GIS solutions.

Click here to purchase ArcGIS products online.

Let us know how GIS is helping you today, talk to us in the comment section!